If you are from India and answer yes to any of the below questions, read on to know more about credit information seen by banks and how you can access your own Credit Information Report.

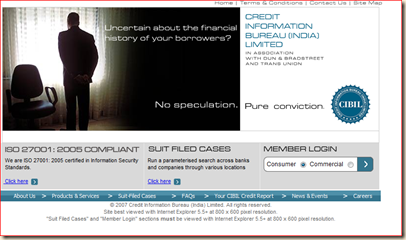

You may be aware of India’s first credit information bureau, Credit Information Bureau (India) Ltd., (CIBIL). CIBIL is a repository of information, which contains the credit history of commercial and consumer borrowers. It primarily gets information from its Members only and at a subsequent stage will supplement it with public domain information in order to create a truly comprehensive snapshot of an entity’s financial track record. It provides this information to its Members in the form of credit information reports.

A Credit Information Report (CIR) is a factual record of a borrower's credit payment history compiled from information received from different credit grantors. Its purpose is to help credit grantors make informed lending decisions - quickly and objectively.

The CIR includes the following information:

-> Basic borrower information like:

-> Name

-> Address

In case of individuals:

-> Identification numbers

-> Passport ID

-> Voters ID

-> Date of birth

In case of non-individuals

-> D-U-N-S® Number

-> Registration Number

-> Legal Constitution

-> Records of all the credit facilities availed by the borrower

-> Past payment history

-> Amount overdue

-> Number of inquiries made on that borrower, by different members

-> Suit-filed status.

It is therefore imperative that your credit information is absolutely correct with CIBIL as all the financial lending institutions make their decisions based on the CIR from CIBIL.

Now it’s also possible to see your very own Credit Information Report. All it requires is to get a Demand Draft for Rs. 142, filled request form which can be downloaded from here, ID proof and address proof. Send all the documents through Indian Post (courier is not accepted) and upon processing you will receive your CIR. You can also get more information about it here. I had applied for my CIR on 20th December 2009 and awaiting the report. Considering the Christmas and New Year holidays gone by, maybe it might take time. Will update once I receive my report.

It may happen that you have made settlement or closed your loans, but the banks have not closed the books from their side. By accessing your credit information report, it will help you find out the status and if there are any errors, the original credit grantor has to be approached so that the deviations, if any, can be fixed by then and corrected in the next upload to reflect the correct picture of your credit history.

![main-content[1] main-content[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiRW0-g8kC42cFWlzUX1js99wP0gKUbsLVmdepmzdO60ud9lB5OEx6ea5qY58qZ8TYViw68Ip6Y5acXWYdiQrvB-vZD5yBiNazXY77XemQ3uah6DzXZuSrSOJq7BU85WTD-xKGu/?imgmax=800)